The information provided on this website does not constitute investment advice or investment recommendations!

The Snegoo® strategy requires its users to comply with the 5 criteria listed below when selecting the companies to invest in. They can be remembered easily:

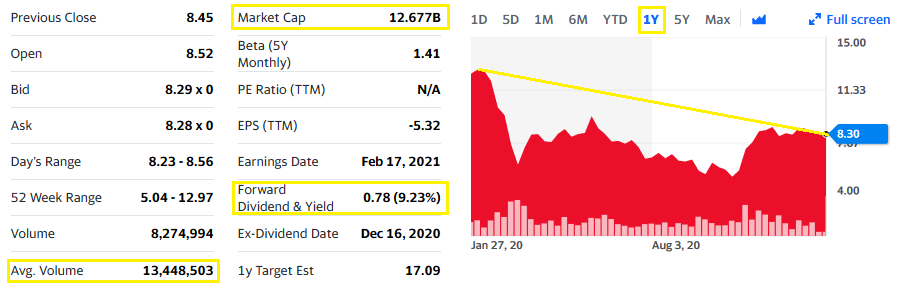

- Look for companies with a long history and with a market value of more than one billion Euros.

- The company should pay a share of their profits in the form of a dividend. The taxable dividend paid should be more than 5% p.a.

- The shares of the selected company should be traded in a large volume during a trading day – e.g. 1 million shares. This is necessary for the immediate buying and selling of shares (liquidity).

- The current share price should have fallen by at least 30% in the course of the last year, ideally as close as possible to the historically lowest price since the company’s shares started to be traded on the stock exchange.

- Buy shares of companies operating in multiple sectors (e.g. financials, energy, automotive, etc.).

An example of a suitable company according to the Snegoo® strategy:

This company is suitable for investment according to the Snegoo® strategy. It has a long-term history; its value exceeds €1 billion; the dividend after taxation it pays out is more than 5% p.a.; the volume of shares traded during a trading day is high, and the share price has decreased by more than 30% in the course of the last year.

(Image source: finance.yahoo.com)